Tesla is the world’s largest electric vehicle maker. Its vehicles are now yielding more profit, but most of its $750bn value is based on products/services that are yet to exist.

Tesla made $20bn of vehicles sales in Q3 and analysts expect 1.8mn cars to be sold this year. Its Q3 earnings were $2.5bn on $25.2bn of revenue.

But a rising share of Tesla’s revenue and profit comes from non car sources e.g.:

Selling carbon credits to other carmakers: that is $2.5bn of revenue in the past year, about 20% of total operating cash flow.

Its Battery and Solar panel business: its growing at 52% a year with higher Gross margins than its cars.

Musk believes automation is the future. He has pivoted strategically towards autonomous driving, AI and robotics, predicting these would soon be Tesla’s main revenue sources and increase its valuation.

Assuming Tesla’s car business is worth $240bn today (from sales of 6m vehicles by 2030) it’s clear that cars are only one part of the $750bn valuation.

The balance of ~$510bn of value could be attributed to Batteries, other Vehicles like Trucks, its Services business, and self-driving robotaxis and Optimus, its Humanoid robot.

Musk says all the company’s vehicles will eventually become one giant autonomous fleet. However, the self driving robotaxis are under development and the build cost is unclear.

On Optimus the humanoid robot, Musk believes this could be worth at least $10tn in long term market value.

Tesla’s shares rose 22% per cent yesterday on upbeat earnings, adding more than $150bn to its market value. Whilst the group is still the most valuable global carmaker, its shares are 50% of their November 2021 peak.

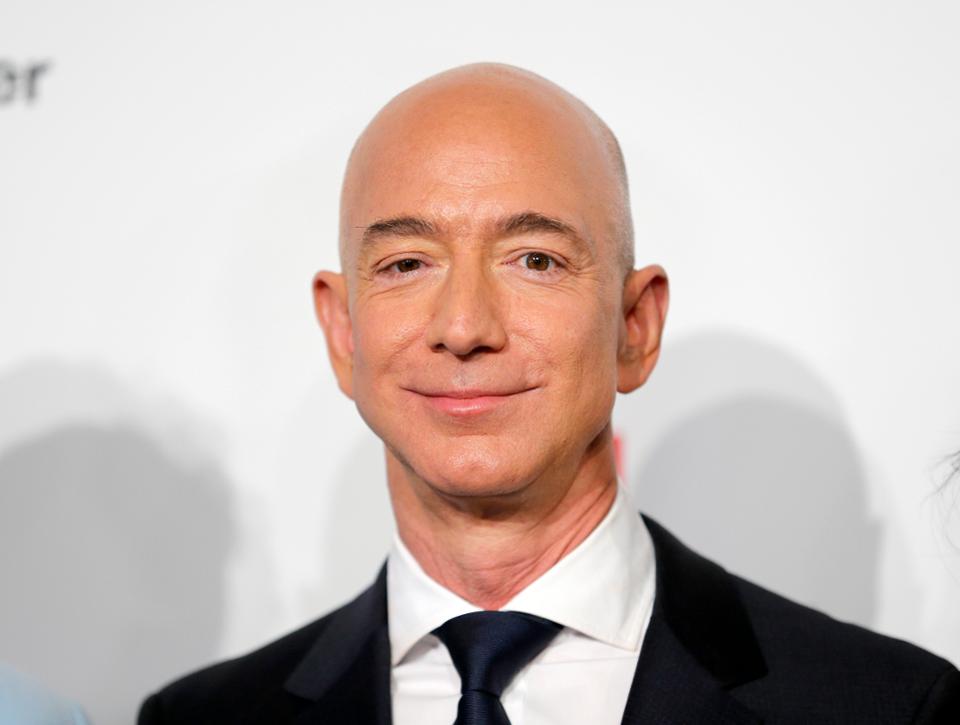

A significant chunk of its current $750bn valuation then is driven by belief in Musk’s vision or his “halo effect”. If Musk is correct, Tesla is undervalued, but he’s known for bold overly optimistic, predictions before…!

#Tesla #AI #Humanoids